Helpful tools to support your go-to-market strategy

In today’s blog we wanted to follow on from our last blog, what is a go-to-market strategy with some useful tools, frameworks and concepts that can help you to review market opportunities and understand the market you are considering entering.

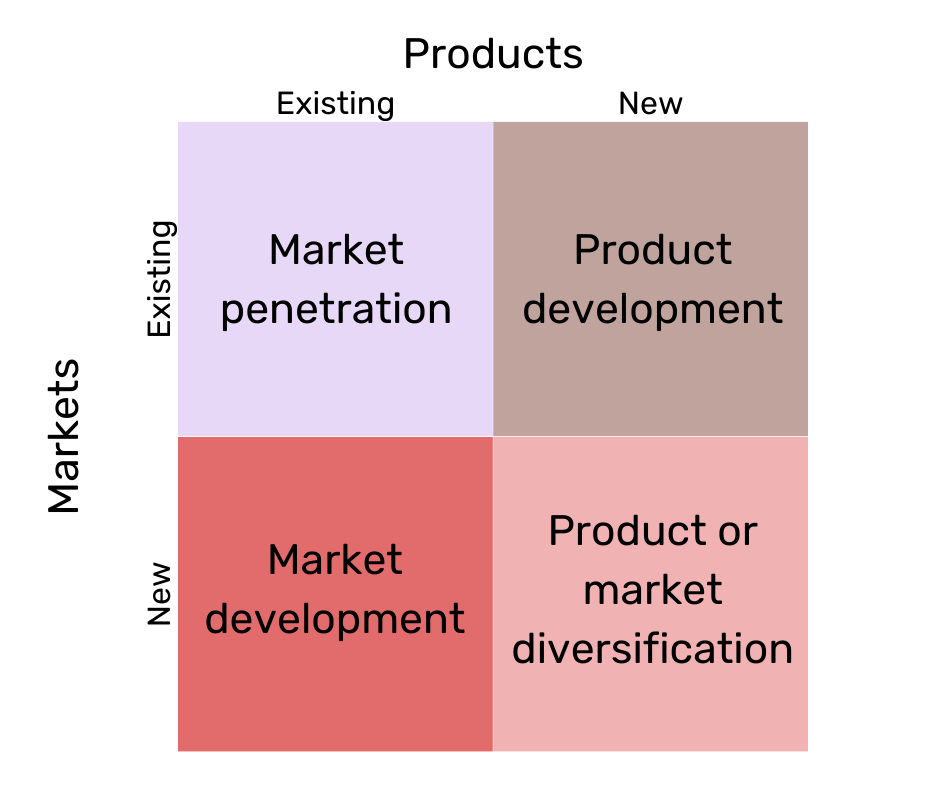

A reminder a go-to-market strategy is a short-term, tactical blueprint specifically focused on a single product launch or entering a new market. Before we dive into tools let’s just refresh ourselves on the Ansoff matrix which helps organisations to map strategic market growth.

Example of Ansoff Matrix

So when we are looking at a go-to-market strategy we have three scenarios being played out:

You have an existing product, but you want enter a new market. For example, you could be selling toothpaste in England and want to expand into Scotland.

You have a new product, that you want to launch in your existing market. Sticking with the toothpaste example, you are going to start selling toothbrushes in England.

And finally, you have diversification, where both the product and market are new.

It is important to understand where the opportunity you are creating a go-to-market strategy sits to get the most out of the tools and frameworks available. At Marketing Moments, we are huge fans of using tools, frameworks and concepts to support people with their thinking and structuring their thoughts. There are so many frameworks available in the world of marketing and business for you to use and if you’re anything like us then they can help you to understand and communicate your recommendations.

Porter’s three tests

The first framework we wanted to talk about was Porter’s Three Tests which is a tool that can be used when you’re entering a new market. So, applying this back to Ansoff Matrix it can help you with market development or market diversification opportunities.

Porter’s three tests are used to help organisations from getting distracted by new “shiney” diversification opportunities providing teams with a focused and consistent way of exploring opportunities. It can help businesses to not enter markets that look exciting but aren’t profitable. Or overpaying to enter a market. This is split into three areas the attractiveness test, the cost of entry test and the better off test. We are going to explain what we mean by each of these.

The attractiveness test

In the attractiveness test you are asking is the new market structurally attractive. The test is evaluating whether the industry you want to enter has the potential for long-term profitability. Key considerations include:

Market growth potential

Competitive intensity

Profitability drivers

Long-term viability and whether the market can support sustainable revenue beyond the cost of entry

It is likely to answer these questions you are going to need to do some desk research, but why not hold a workshop with your project team on competitors to really understand the drivers sitting behind your competitors.

The cost of entry test

The second test is the cost of entry – will the cost of entering the market erode the potential returns? Even if the market is attractive, diversification only creates value for your brand if the expected returns exceed the cost of entry. The cost of entry is hugely variable across different industries, but some key considerations include:

Capital investment required – this is things like will you need a warehouse, building, equipment

Regulatory or technological barriers

Marketing and brand-building costs – this is often forgotten or underestimated, but you need to invest in marketing when entering a new market where you don’t have the same brand awareness or engagement

The better off test

The third test is the better off test – will the company and new business be better off together than apart? This is fundamentally a structure question about the benefit of this diversification. Porter, emphasised that diversification should create synergy, meaning: shared capabilities, economies of scale, cross-selling opportunities, brand leverage, knowledge transfer and operational efficiencies. To put it simply if the combined entity cannot outperform the two businesses operating independently, then the diversification fails this test.

You may want to strengthen this further by using other frameworks like Porter’s Five Forces or a PESTLE analysis to really ensure you’ve understood the market dynamics.

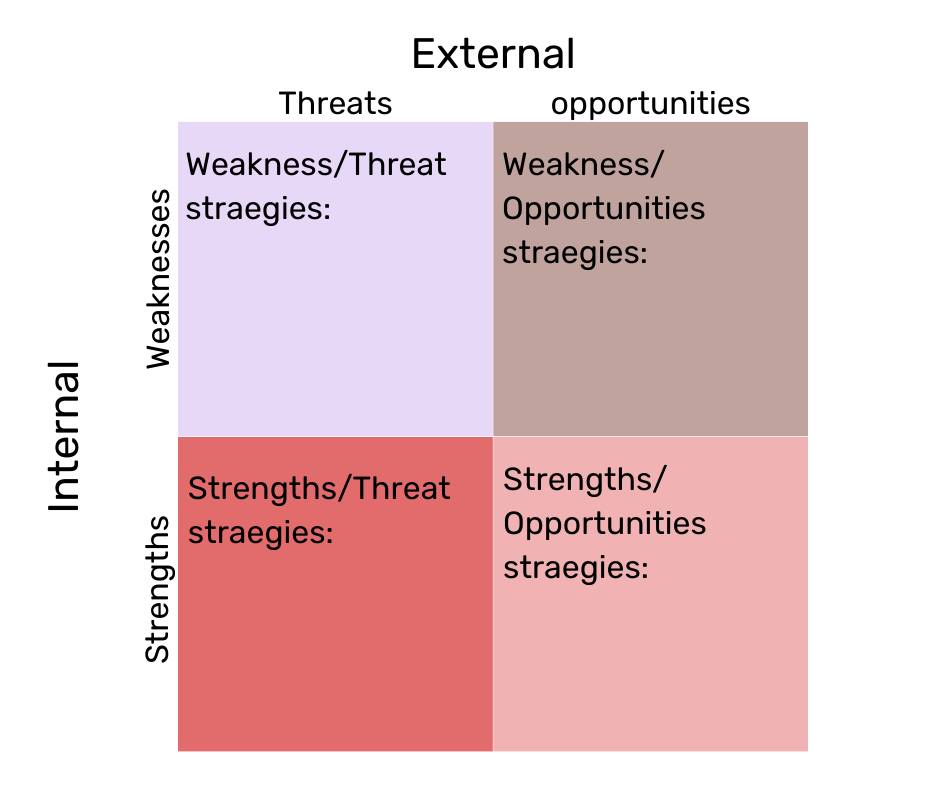

Not just a SWOT a TOWS analysis

We have found that SWOT analysis are often used incorrectly or people struggle to turn observations into actions. This is why we are huge fans of TOWS analysis. As it put the focus on the strategies you need to put in place to take advantage of opportunities and mitigate risks. One of the biggest mistakes we see teams make when they do a SWOT analysis is not understanding what is relating to the company and what is about the external environment. To put it simply:

Strengths and weaknesses: apply to the business what are your strengths and weaknesses

Opportunities and Threats: are things outside of your business direct control. For example, an opportunity could be the ageing population is increasing in the market you want to enter and your strength is the product matches the needs of an aging population. A threat could be a competitor has just launched a competing service in that market.

We think it always a really nice group or workshop exercise to map out these, but then turn it into a framework that looks like this:

An example of a TOWS analysis

Spend the second half of the workshop discussing what needs to happen when you pair a strength with an opportunity (or one of the other central grids). For example, if we stick with the ageing population above then the strategy is:

Explore routes to market to enable market development and build focus on brand awareness activities with the ageing population

Whereas, with the competing service the strength/threat (ST) strategy could be something like focus on building brand credibility through social proofing and content marketing.

If you’re scenarios are often related to brand awareness and equity you may also want to consider models like Keller’s CBBE pyramid, sometimes called Brand Resonance Model. Other useful models that can help frame thinking especially around competition is to consider your strategic position using one of the three porter’s generic strategies. This will help you to understand what you want to be competing on cost or focus or differentiation. Spoiler alert, you can’t do it all!

We hope that you’ve been enjoying this mini-series of blogs relating to creating your own go-to-market strategy. In the next blog we are going to talk through more of the marketing, promotional elements. So stay tuned for more updates from us.